- February 14, 2026

Best Commercial Office Space in Wagholi, Pune | Wagholi High Street by GS Developers

Wagholi has moved from a purely residential extension of Kharadi to a serious commercial node for offices, clinics, showrooms, and small businesses. Its location along the Pune–Ahmednagar Highway (Nagar Road), proximity to EON IT Park and World Trade Center, and the upcoming Ring Road and Metro extension are making it attractive for both daily-business use and long‑term investment.

Several infrastructure projects are strengthening this belt: a six‑tier flyover and six‑lane upgrade between Yerwada and Kharadi, the proposed elevated Kesnand–Shirur corridor, and the Outer Ring Road phase that connects Theur–Kesnand–Wagholi–Charholi. For businesses, this translates into a faster commute for staff, better access for customers, and improved visibility for roadside commercial projects in the Wagholi–Kesnand stretch.

Location Advantage of Office Space in Wagholi

When you choose an office in Wagholi, you tap into the larger “Pune East” business belt that includes Kharadi, Viman Nagar, Magarpatta and Nagar Road. Many companies actively compare Wagholi with Kharadi, Nagar Road, Awhalwadi, Vithalwadi and Chokhi Dhani for new office requirements because of similar catchments and better value on entry cost.

Key micro‑pockets you should know about include Nagar Road‑touch properties, Ubale Nagar, Kharadi Annex/Upper Kharadi, Bakori Phata, and the Kesnand Road belt where Wagholi High Street is located. Being closer to main roads or future Ring Road access points generally means stronger branding, easier logistics, and better rental or resale potential over time.

Typical Office Sizes and Rental Benchmarks in Wagholi

From major listing platforms, you can broadly understand how office sizes and rents behave in Wagholi today. Smaller offices of about 270–500 sq ft usually see monthly rents in the ₹10,000–25,000 range, depending on visibility, furnishing and building quality. Mid‑sized spaces around 800–2,000 sq ft can command ₹50,000–90,000 per month, while larger offices of 3,500–6,000+ sq ft in Grade A buildings can reach ₹1.5–2.4 lakh or more.

This pattern matches the wider Wagholi–Kharadi belt, where SMEs often work within 400–3,500 sq ft and corporates or co‑working operators may look at 3,000–4,000 sq ft and above in tech‑park‑style projects. For investors, this structure helps you see where “high‑demand bands” lie, so you can match your budget and risk appetite to the ticket size that has depth of demand.

Wagholi High Street: Best Commercial Office Space in Wagholi

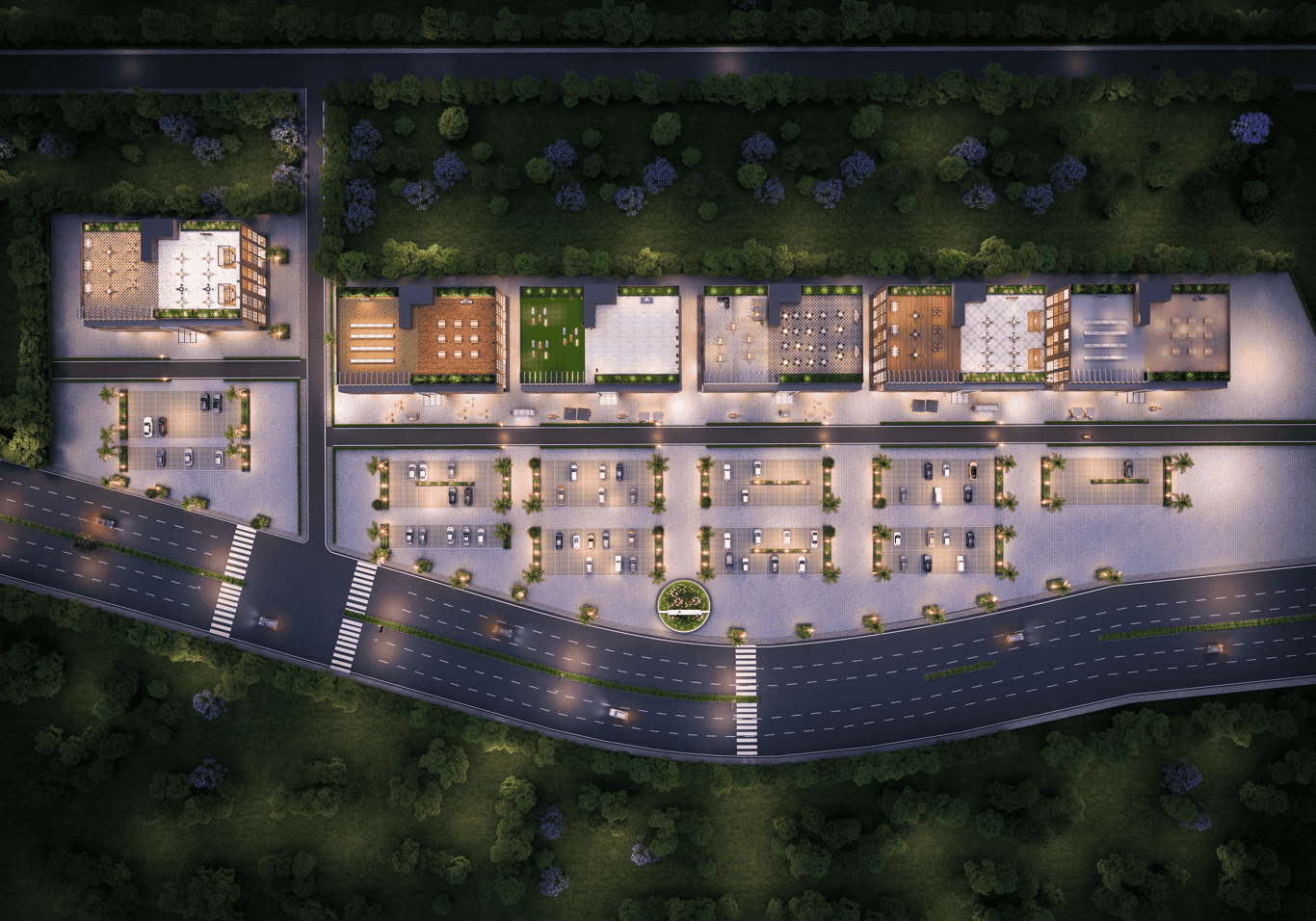

Wagholi High Street by GS Group (GS Developers) is a 5.5‑acre open‑air commercial destination on Kesnand Road, planned as a true high‑street rather than a closed mall. Five low‑rise G+3 towers combine high‑visibility retail shops, boutique offices and larger showrooms to create a central business hub for the Kesnand–Wagholi belt.

Project scale and structure

Total land area: ~5.5 acres with 5 commercial towers (G+3).

Building C (current launch): ~0.73 acres with 122 commercial units.

Ceiling height: up to ~14 ft for selected ground‑floor showrooms, supporting powerful storefronts and signage.

Timeline: Phase 1 fully sold out; Building C launched on 14 February 2025 with RERA possession date of 31 December 2027.

Unit configurations, sizes and indicative pricing

| Unit Type | Carpet Area (approx.) | Ticket Size Band (indicative) | Typical Use‑Cases |

|---|---|---|---|

| Boutique Offices | 121 – 136 sq.ft. | From ~₹40 lakh + taxes. | CAs, consultants, clinics, small firms, start‑ups. |

| Retail Shops | 130 – 250 sq.ft. | From ~₹65–80 lakh + taxes. | Fashion, electronics, salons, QSRs, service stores. |

| Large Showrooms | 500+ sq.ft. (flexible). | From ~₹1.5 crore+. | Anchor brands, automotive, jewellery, multi‑brand. |

Unit configurations, sizes and indicative pricing

Rooftop cafés, restaurants, game zones and a yoga lounge to extend dwell time and encourage repeat visits.

Business lounge and co‑working spaces for meetings, plug‑and‑play work and networking.

100% power backup, 24×7 security, CCTV, fire‑fighting systems and high‑speed lifts for seamless daily operations.

Ample visitor and owner parking to support both quick errands and destination shopping.

A confirmed upcoming McDonald’s anchor that acts as a strong footfall magnet and visibility driver for neighbouring shops.

Ready‑to‑Move vs Under‑Construction Commercial Offices in Wagholi

In Wagholi, you will find both ready‑to‑move and under‑construction commercial projects, each with its own advantage. Ready‑to‑move and fully furnished options allow immediate occupation with lower initial disruption but usually come at a higher per‑sq‑ft cost and may involve compromises on layout or branding.

Under‑construction offices, especially in upcoming Grade A high‑street or tech‑park style projects, can offer better specifications, modern design and a clear story of future infrastructure around them. However, they require more planning around possession timelines, GST, interest costs during construction and clarity on the developer’s track record.

Commercial Property Loan Interest Rates (February 2026)

Financing commercial purchases is common. Banks offer loans at higher rates than home loans because commercial assets are considered riskier.

Current interest rates for commercial property loans in India range from 8.70% to 12.75% per annum, depending on your CIBIL score, business vintage, and loan amount. Loan-to-value (LTV) ratios are typically 55% to 70%, meaning you need a 30–45% down payment.

Maximum tenure is usually 15 years, though some lenders extend up to 20 years. Shorter tenures mean higher EMIs but lower total interest.

Commercial Property Loans, Interest Rates and Eligibility: Quick Snapshot

Many buyers fund their commercial office purchase partly through bank or NBFC loans, and current rate trends show steady interest in commercial lending products. As of February 2026, typical advertised interest ranges for commercial property loans are:

HDFC Bank: Around 8.75–9.40% p.a. with up to 1% processing fee and maximum tenure of 15 years.

SBI: About 10.10–11.80% p.a. with ~1% processing fee and 15‑year tenure.

L&T Finance: Starting around 8.70% p.a., up to 2% processing, with tenures up to 20 years.

PNB Housing: Around 8.75–11.05% p.a., typically up to 15 years.

Axis Bank: Roughly 9.40–10.95% p.a., with ~1% or minimum fee and tenure up to 20 years.

ICICI Bank: About 10.85–12.50% p.a., with 1.5–2% processing fee and 15‑year cap.

Lower rates in the 8.7–9.0% band are usually reserved for applicants with CIBIL scores of around 800+ and at least three years of strong business vintage.

How Commercial Loans Differ From Home Loans

Commercial real‑estate loans differ from regular home loans in three major ways.

Loan‑to‑Value (LTV): Banks usually fund only about 55–70% of the commercial property’s market value, so you should plan a 30–45% down payment.

Tenure: Tenure is typically capped at 15 years, though some NBFCs like L&T Finance or Axis Bank may extend to 20 years; this higher EMI period means you should track cash flows carefully.

Prepayment Charges: For floating‑rate loans taken by individuals, prepayment is often allowed without charges, but fixed‑rate loans or loans taken in the name of a company/firm may face 2–4% prepayment penalties on the outstanding principal.

Lenders focus heavily on business continuity (usually at least three profitable years) and Net Operating Income to ensure that your Debt Service Coverage Ratio is comfortable. For under‑construction projects, banks commonly prefer MahaRERA‑registered properties that have crossed a certain construction progress threshold.

Read More

Property Investment for Beginners

Property investment for beginners in Pune starts with simple steps...

Read MoreWagholi–Kesnand to Purandar Airport via Ring Road

Discover how the Pune Ring Road connects Wagholi–Kesnand to Purandar...

Read MoreCommercial Property for Sale in Pune

Find commercial property for sale in Pune with high yields...

Read More