- February 13, 2026

Commercial Shops for Sale in Pune – Street‑Facing Shops at Wagholi High Street

Pune’s demand for commercial shops is shifting from a few saturated high streets to new corridors shaped by IT parks, upcoming metro lines and the Ring Road. If you are actively searching for a commercial shop for sale in Pune, Wagholi High Street on Kesnand Road offers a curated high‑street option in East Pune with realistic ticket sizes, infra‑backed upside and a transparent developer behind it.

Market Snapshot of Commercial Shops for Sale in Pune 2026

Buyers today see thousands of “shops for sale in Pune” across Baner, Kharadi, Wakad, Viman Nagar, PCMC and newer eastern pockets, but most listings only show price, area and a few hype lines. Price bands range from roughly ₹20–60 lakh for small shops in peripheral belts to ₹3–5 crore for larger, pre‑leased assets on premium high streets like JM Road, Baner, Viman Nagar and Koregaon Park.

On the supply side, the west corridor (Baner–Balewadi–Wakad–Hinjewadi) is a mature IT‑driven zone with high entry prices and more intense high‑street competition. The east corridor (Kharadi–Viman Nagar–Wagholi) combines strong IT‑led demand with relatively lower entry prices and a strong infra pipeline (Ring Road, Nagar Road upgrades, metro extension), giving investors a better balance between capital cost and future appreciation potential.

We recently explored this in our discussion on “Why Wagholi’s Rental Yield Outpaces West Pune“

Why Wagholi–Kesnand Is an Emerging High‑Street for Pune Businesses

Many business owners who compare Kharadi, Baner, Wakad and Pimpri‑Chinchwad now also look at Wagholi–Kesnand as a serious alternative. The reason is simple: the eastern Ring Road alignment (Theurphata–Kesnand–Wagholi–Charholi) and the 120 ft Kesnand Link Road connect this belt not just to Nagar Road, but also to the Solapur side and the future Purandar Airport corridor.

MSRDC’s approval for a six‑lane, multi‑level flyover upgrade on the Pune–Ahmednagar Highway between Yerwada and Kharadi, plus the planned Kesnand–Shirur elevated corridor, is turning Nagar Road–Wagholi into a faster arterial spine. At the same time, the Ramwadi–Wagholi Metro extension with 11 new stations and a parallel elevated road package aims to ease the worst bottleneck between Ramwadi and Wagholi over an estimated 42‑month execution period.

Why Wagholi–Kesnand Is an Emerging High‑Street for Pune Businesses

| Factor | Wagholi–Kesnand (East Pune) | Baner / Wakad / Viman Nagar |

|---|---|---|

| Entry ticket (typical) | Smaller shop sizes and lower per‑sq.ft pricing. | Higher capital values in long‑matured belts. |

| Yield potential | Commercial yields targeted around 6–7%. | Percentage yields often compressed vs ticket size. |

| Infra pipeline | Ring Road, metro extension, Nagar Road upgrade. | Mostly incremental upgrades on an already‑built network. |

| Catchment profile | Fast‑growing residential + IT‑linked population. | Mature, highly competitive high‑street nodes. |

Read More: “Pune Ring Road and Wagholi’s Rise”

Wagholi High Street: A Curated High‑Street for Shops, Offices & Showrooms

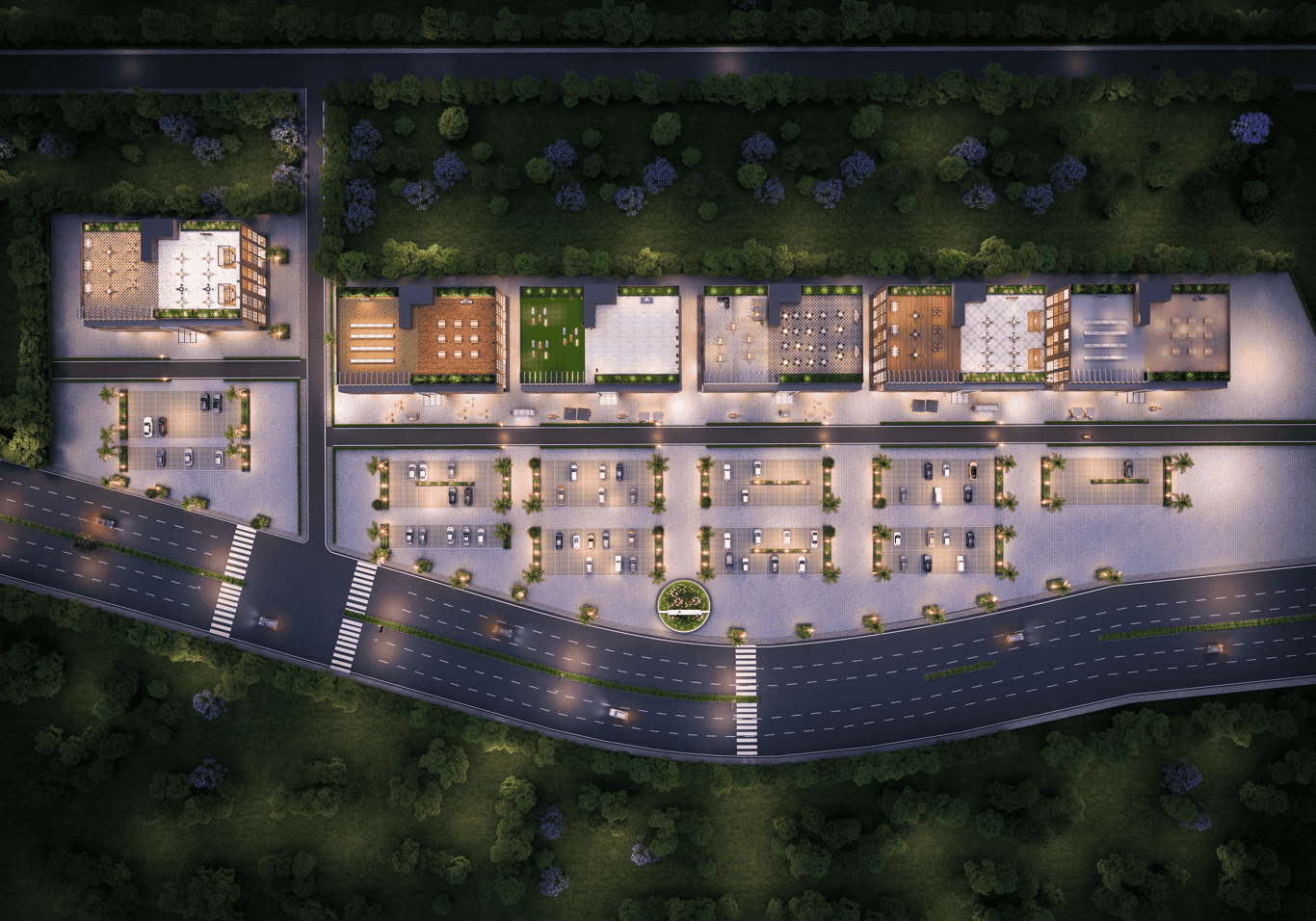

Wagholi High Street by GS Group (GS Developers) is a 5.5‑acre open‑air commercial destination on Kesnand Road, planned as a true high‑street rather than a closed mall. Five low‑rise G+3 towers combine high‑visibility retail shops, boutique offices and larger showrooms to create a central business hub for the Kesnand–Wagholi belt.

Project scale and structure

Total land area: ~5.5 acres with 5 commercial towers (G+3).

Building C (current launch): ~0.73 acres with 122 commercial units.

Ceiling height: up to ~14 ft for selected ground‑floor showrooms, supporting powerful storefronts and signage.

Timeline: Phase 1 fully sold out; Building C launched on 14 February 2025 with RERA possession date of 31 December 2027.

Unit configurations, sizes and indicative pricing

| Unit Type | Carpet Area (approx.) | Ticket Size Band (indicative) | Typical Use‑Cases |

|---|---|---|---|

| Boutique Offices | 121 – 136 sq.ft. | From ~₹40 lakh + taxes. | CAs, consultants, clinics, small firms, start‑ups. |

| Retail Shops | 130 – 250 sq.ft. | From ~₹65–80 lakh + taxes. | Fashion, electronics, salons, QSRs, service stores. |

| Large Showrooms | 500+ sq.ft. (flexible). | From ~₹1.5 crore+. | Anchor brands, automotive, jewellery, multi‑brand. |

Standard shop frontage is in the ~10–12 ft band, a practical width for display planning and brand signage on a high‑traffic arterial road. In contrast to scattered standalone units, this single organised high‑street cluster gives investors and occupiers more control over brand environment, footfall quality and facility management.

Unit configurations, sizes and indicative pricing

Rooftop cafés, restaurants, game zones and a yoga lounge to extend dwell time and encourage repeat visits.

Business lounge and co‑working spaces for meetings, plug‑and‑play work and networking.

100% power backup, 24×7 security, CCTV, fire‑fighting systems and high‑speed lifts for seamless daily operations.

Ample visitor and owner parking to support both quick errands and destination shopping.

A confirmed upcoming McDonald’s anchor that acts as a strong footfall magnet and visibility driver for neighbouring shops.

Location & Connectivity: Why This Micro‑Location Works for Shops

Wagholi High Street sits on Kesnand Main Road with direct access to the 120 ft Link Road that bridges Nagar Road and the Solapur side. This gives businesses the ability to serve dense local residential catchments as well as regional through‑traffic that will increasingly be routed via the Ring Road and external bypass instead of inner‑city choke points.

Approximate distances underline its day‑to‑day convenience: about 3 km to Pune–Ahmednagar Highway (Nagar Road), ~4.5 km to EON IT Park (Kharadi), ~6 km to World Trade Center, around 0.10 km to the nearest hospital and ~0.34 km to a leading school (Vibgyor Rise). With Ring Road, metro and highway upgrades converging here, Wagholi High Street is positioned as a Ring‑Road‑ready, metro‑linked commercial hub rather than just another roadside complex.

Who Should Buy These Shops?

Wagholi High Street is designed for buyers who want more than a generic listing – they want a high‑street platform that can support visibility, walk‑ins and long‑term brand positioning in East Pune. The project’s mix of compact, mid and large formats caters to both first‑time commercial buyers and seasoned investors.

Ideal business use‑cases

Clinics, diagnostics & wellness: The immediate presence of hospitals, schools and residential societies supports clinics, diagnostics centres, dental practices and wellness studios that depend on repeat local visitors.

Salons, fashion, electronics & QSRs: Street‑facing visibility, planned anchors and lifestyle amenities favour salons, fashion and gadget stores, cafés and QSR brands that thrive on impulse and repeat footfall.

Professional offices: Boutique offices suit CAs, advocates, consultants, small agencies and satellite offices that want an East Pune business address close to Kharadi’s IT ecosystem.

Education & services: Coaching centres, training studios and service‑oriented businesses can tap into the student and young‑professional population in Wagholi.

Investor profile and yield logic

Investors targeting around 6–7% gross rental yields, along with infra‑driven appreciation, often find this corridor an attractive balance between risk and reward. Compared to high‑ticket inner‑city or west Pune high streets, Wagholi’s more accessible capital values and growing demand can translate into a stronger yield‑to‑investment ratio.

Read More on “Property Investment for Beginners“

Pricing, Returns & Exit Strategy for Shops in Pune

In the current market, small shops in outer belts can begin in the ₹20–60 lakh range while large, well‑located, pre‑leased shops on prime high streets can reach ₹3–5 crore and beyond. Wagholi High Street positions its pricing (around ₹40 lakh+ for offices, ₹65–80 lakh+ for shops and ₹1.5 crore+ for bigger showrooms) between these extremes, offering organised, infra‑linked commercial real estate at a mid‑segment ticket size.

Within this zone, commercial shop yields are typically estimated in the ~6–7% bracket, which is often higher than residential yields in mature west Pune localities that average closer to 3–4%. As key projects like the Ring Road and metro extension move from plan to reality, early investors stand to benefit from a combination of rental income and capital appreciation.

Exit options and holding strategy

Lease‑and‑hold: Secure a stable tenant and hold through multi‑year infra completion to capture both rent and appreciation.

Gradual upgrade: Start with a boutique office or small shop and upgrade within the project as your business or portfolio grows.

Strategic resale: Consider selling once infra and catchment stories are fully visible and yields have compressed, attracting yield‑focused buyers who prefer tenanted, stabilised assets.

GST on Commercial Shops in Pune: What Buyers Commonly Ask

Many buyers today specifically ask about GST on commercial shop rent and on the purchase of under‑construction units before they finalise a deal. In India, renting or leasing out a commercial property (shop, office, warehouse) is treated as a taxable service, and GST at 18% is typically applicable on the rent received, subject to registration thresholds and current law.

For purchases, under‑construction commercial property is generally subject to GST on the agreement value, while completed, ready‑to‑move units with a completion certificate usually fall outside GST and attract only stamp duty and registration. As a working rule, buyers often plan for around 12% effective GST load (after land abatement) on under‑construction commercial units, depending on the specific category and scheme applicable at the time of purchase. Always confirm the exact rate and structure with your tax advisor at the time of booking.

Stamp Duty on Commercial Property in Pune

Buyers also pay close attention to “stamp duty for commercial property in Pune” because it materially changes the all‑in cost. In Pune’s urban areas, total stamp duty components typically work out to about 7% for male buyers and 6% for female buyers, plus a 1% registration fee capped at ₹30,000 for properties above ₹30 lakh.

Budgeting for statutory charges

Always add stamp duty, registration and GST (if applicable to an under‑construction commercial unit) to your base property price before deciding affordability.

Most lenders finance a percentage of the agreement value; statutory charges and interior costs are usually from your own contribution.

Read more on “Stamp Duty & Registration Charges in Pune“

Commercial Property Loan Interest Rates in 2026

Prospective buyers increasingly check loan eligibility and EMI impact early in their decision‑making by searching around “commercial property interest rate” or “loan for commercial property.” As of early 2026, commercial purchase loans for shops and offices generally fall in a broad 8.7–11.8% per annum range across major banks and NBFCs, depending on CIBIL score, borrower profile and loan product.

How commercial purchase loans differ from home loans

Loan‑to‑Value (LTV): For commercial purchases, lenders typically fund 55–70% of the property value, which means you must plan for 30–45% down payment.

Tenure: Tenure is usually capped at 15 years, with some NBFCs offering up to 20 years, resulting in higher EMIs versus long‑tenure home loans.

Prepayment: Floating‑rate loans to individuals may have nil prepayment penalty, while fixed‑rate loans or loans to firms/companies can attract 2–4% pre‑closure charges on principal outstanding.

Loan for Commercial Property vs Loan Against Property

Another common decision is whether to take a dedicated commercial purchase loan for a new shop or to use an existing asset as security through a Loan Against Property. For a shop in a project like Wagholi High Street, most first‑time investors prefer a straightforward commercial purchase loan linked to the new property itself.

Purchase loan vs LAP – typical patterns

Commercial purchase loan: Used to buy a new shop/office; strong profiles can access rates toward the lower end of the commercial band.

Loan Against Property (LAP): Raised against an existing residential or commercial property; rates are usually higher and documentation centres on that existing asset.

Investors who already own property sometimes use LAP for business capital, while new investors buying their first commercial shop often find it simpler to structure a pure purchase loan on the shop itself.

Commercial Property Insurance & Risk Cover

Along with GST and loans, many buyers now ask how to protect their shop investment and rental cash flows with commercial property insurance. A suitable policy can cover structural damage, selected natural events and, in some products, loss of rent due to insured incidents, which is especially important for visible, street‑facing shops.

What to look for in an insurance policy

Coverage for structure, internal fit‑outs and façade/plate glass, which are crucial for high‑street retail.

Optional covers such as loss‑of‑rent and public liability, particularly for customer‑facing brands.

Policy terms that align with lender requirements if the shop is financed through a commercial loan.

Property Tax Pune, TDS on Rent & Ongoing Costs

Buyers also want clarity on ongoing charges like property tax, maintenance and tax treatment of rental income once the shop is leased. Commercial units in Pune typically attract higher property‑tax slabs than residential and also involve common‑area maintenance, utilities, insurance and professional fees.

If the rent crosses the applicable threshold, tenants may have to deduct TDS on rent, which is then available as credit while you compute your taxable income. In organised developments like Wagholi High Street, common‑area maintenance supports security, cleanliness, lighting and landscape – all of which protect the long‑term value of your shop and the overall high‑street experience.

Why Choose a GS Developers High‑Street Shop vs Generic Portal Listings

Online portals are useful to understand locality spreads and price bands, but they offer fragmented cards with very little guidance on how to actually choose one shop over another. A dedicated GS Developers page for commercial shops for sale in Pune, anchored around Wagholi High Street, gives you a complete view – from infra story and catchment logic to shop design, pricing, yields, GST, stamp duty and lending basics.

Buying directly from GS Developers means engaging with a RERA‑registered team, reviewing transparent documentation and aligning with a long‑term vision for the Wagholi–Kesnand high‑street corridor. It also helps you save brokerage and structure payment schedules, fit‑out timelines and possession planning in a way that suits your business and investment goals.

Read More

Commercial Property for Sale in Pune: 2026 Buyer’s Guide

Pune's commercial real estate market is growing fast. More businesses...

Read MorePune Ring Road and Wagholi’s Rise

Pune’s Ring Road is more than a highway—it’s a growth...

Read MoreUpcoming Affordable Areas in Pune 2026

Discover top upcoming affordable areas in Pune 2026 like Wagholi,...

Read More