Stamp Duty and Registration Charges in Pune 2026

Planning to buy a home in Pune? You need to know about stamp duty and registration charges. These are fees you pay to make your property deal legal. This guide tells you everything about rates, how to pay, and ways to save money.

What Is Stamp Duty and Why Do You Pay It?

Stamp duty is a tax the state takes when you buy property. It makes your sale agreement valid in court. Without it, your papers have no legal power.

Registration charges go to the government for putting your deal in their records. This keeps your property safe from fraud. Both charges together form a big part of your home buying taxes breakdown.

Key points:

Stamp duty makes papers

legalRegistration keeps records safe

Both are must-pay for any property deal

Stamp Duty Rates in Pune for 2026: Men, Women, and Joint Owners

Rates change based on who buys and where. In PMC and PCMC area stamp duty rates, you pay a mix of base duty, metro cess, and local body tax.

>| Buyer Type | Urban (PMC/PCMC) | Gram Panchayat Areas | Registration Fee |

|---|---|---|---|

| Male | 7% (5% + 1% LBT + 1% Metro) | 4% (3% + 1% ZP Cess) | Rs 30,000 or 1% |

| Female | 6% (4% + 1% LBT + 1% Metro) | 3% (2% + 1% ZP Cess) | Rs 30,000 or 1% |

| Joint (Male + Female) | 6.5% | 3.5-4% | Rs 30,000 or 1% |

| Joint (Female + Female) | 6% | 3% | Rs 30,000 or 1% |

How Does Gender and Location Change Your Costs?

Women save 1% on stamp duty in Maharashtra. This is a government push to help more women own homes. If you add your wife’s name, you pay 6.5% instead of 7%.

Location matters too:

Location matters too:

Gram Panchayat property registration rules give lower rates (3-4%)

Urban areas like PMC and PCMC charge more (6-7%)

Rural MMRDA and Cantonment areas fall in between (5%)

Ready Reckoner Rate vs Agreement Value: Which One Counts?

You pay stamp duty on whichever is higher — your deal price or the Ready Reckoner rate. The Ready Reckoner is the government’s set price for land in each area.

In April 2025, Pune saw a 6.8% jump in Ready Reckoner rates. PCMC went up by 6.69%. Experts think rates may go up 5-7% more in April 2026.

Why this matters:

Even if you get a lower price, you pay duty on the Ready Reckoner rate

Higher rates mean higher stamp duty

Plan your budget with the higher number in mind

Stamp Duty on Resale Flat in Pune: Same Rules Apply

Buying an old flat? The rules stay the same. You pay based on Ready Reckoner or sale price, whichever is more. Both new and resale flats follow the same stamp duty on resale flat in Pune rules.

For an Rs 80 lakh resale flat, a male buyer pays about Rs 5.6 lakh as stamp duty.

How to Calculate Stamp Duty: Step-by-Step

Here’s how to work out your costs:

Find property value – Check Ready Reckoner rate and your agreement price

Pick the higher value – This is your base for duty

Apply your rate – 7% for men, 6% for women in urban Pune

Add registration – 1% of value or Rs 30,000 (whichever is less)

Example:

Flat value: Rs 70 lakh

Male buyer: Rs 70 lakh × 7% = Rs 4.9 lakh stamp duty

Registration: Rs 30,000 (capped)

Total: Rs 5.2 lakh

How to Pay Stamp Duty Online in Pune

Online stamp duty payment Pune is simple through the GRAS Mahakosh portal. No need to visit offices for payment.

GRAS Mahakosh payment steps:

Go to gras.mahakosh.gov.in

Pick “Inspector General of Registration”

Enter property details and amount

Pay via net banking or card

Get e-SBTR receipt

How to pay IGR Maharashtra challan:

Generate challan on GRAS

Print and pay at any bank

Get receipt for records

Stamp duty payment receipt download from the portal after payment is done. Keep this safe for registration day.

e-SBTR vs Franking: Which Payment Method to Choose?

Both work for paying stamp duty. Here’s the difference:

| Method | How It Works | Best For |

|---|---|---|

| e-SBTR | Online payment through GRAS portal | High-value deals, quick processing |

| Franking | Bank stamps your papers | Smaller amounts, walk-in option |

Documents You Need for Property Registration

Book your SRO office appointment for registration online first. Then gather these papers:

Sale deed or agreement

PAN card and Aadhaar of buyer and seller

Latest property tax receipt

Encumbrance certificate

ID proof of two witnesses

Passport photos

Stamp duty payment receipt

Pune now lets you register at any of 49 SRO offices in the district. This “One District, One Registration” rule saves time.

Stamp Duty Exemption Rules and Savings

Some deals attract lower or no stamp duty:

Family gift deeds: Transfer to spouse, children, or grandchildren costs just Rs 200

Sibling transfers: Not covered — pay 3% of value

Integrated townships: Get 50% rebate on stamp duty

Tax benefit on stamp duty (Section 80C):

Claim up to Rs 1.5 lakh deduction

Only in the year you pay

Covers both stamp duty and registration charges

Pune vs Other Maharashtra Cities: Rate Comparison

| City | Male Buyer | Female Buyer | Registration |

|---|---|---|---|

| Pune (Urban) | 7% | 6% | Rs 30,000 cap |

| Mumbai | 6% | 5% | Rs 30,000 cap |

| Thane | 7% | 6% | Rs 30,000 cap |

| Nagpur | 7% | 6% | Rs 30,000 cap |

Common Mistakes to Avoid When Paying Stamp Duty

Many buyers make these errors:

Under-declaring property value – Government checks Ready Reckoner rates

Ignoring metro cess – It’s part of the law now

Delaying registration – Fines add up fast

Relying only on sale price – Ready Reckoner may be higher

Skipping mutation – Do it after registration to update records

Your Next Step Toward Homeownership

Stamp duty and registration add 7-8% to your home cost in Pune. Know these charges before you sign any deal. Women buyers and those buying in Gram Panchayat areas save more.

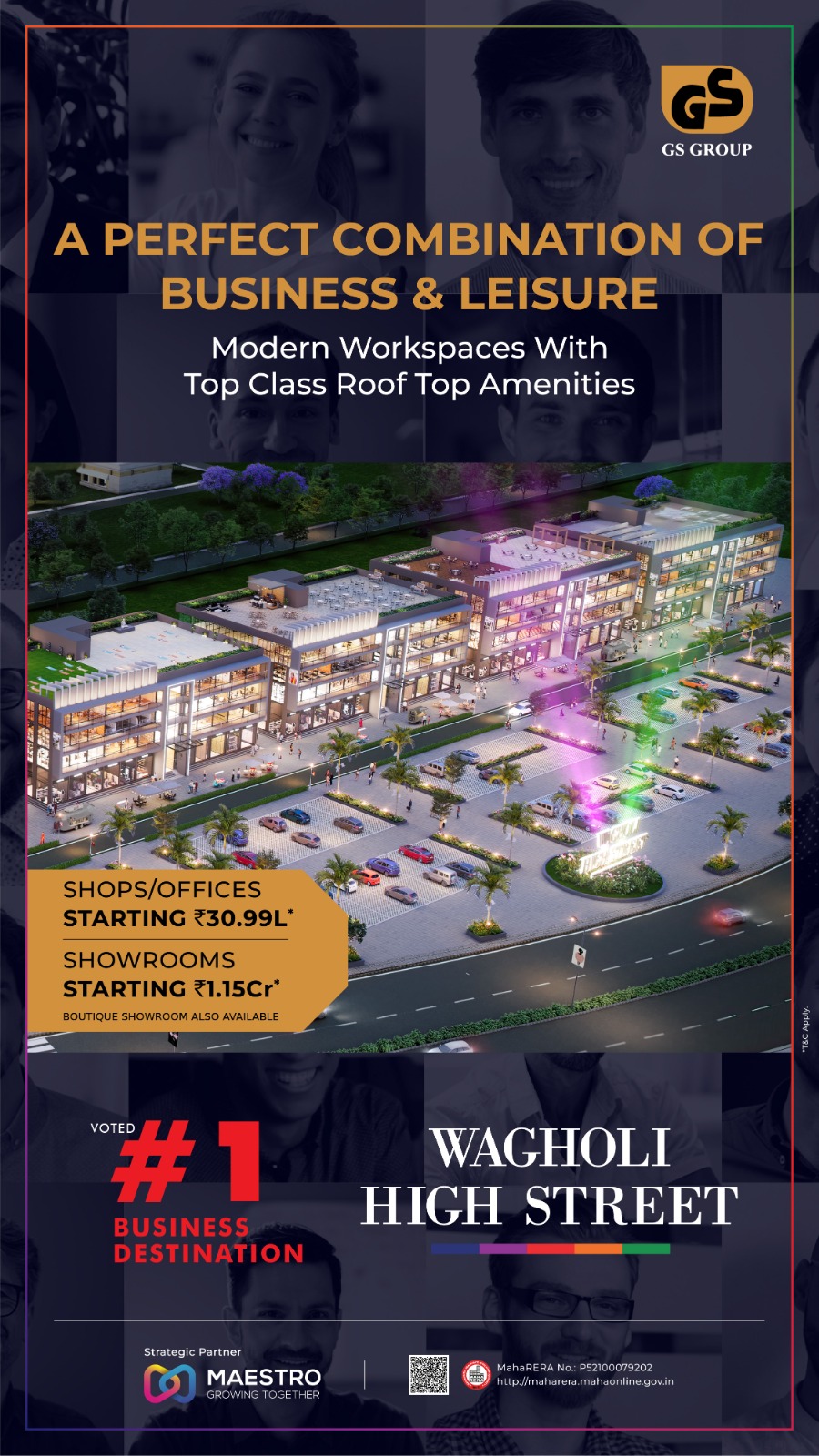

Looking for a home in growing areas like Wagholi, Moshi, or Kesnand? GS Developers helps over 1,500 families find homes that fit their budget and goals.

Read More

Best Residential Area in Pune 2026

Top neighborhoods like Koregaon Park, Baner, Kharadi & Hinjewadi for...

Read MoreMetro to Wagholi : Metro Will Shape Homes, Rents, and High-Street Retail

Pune Metro’s Aqua Line is expanding from Vanaz to Chandani...

Read MoreCommercial Property for Sale in Pune

Find commercial property for sale in Pune with high yields...

Read More