- February 6, 2026

The Tax Benefits of Investing in Commercial Properties for Salaried Professionals

Salaried professionals often seek ways to cut their tax bill while building wealth. Commercial

property investments stand out by turning rental income into tax-efficient assets. In India’s old

tax regime, these perks make commercial spaces a smart addition to your portfolio.

With yields up to 6-10% in areas like Pune, you get income plus deductions that residential can’t

match.

Key Tax Deductions on Rental Income

Rent from commercial properties counts as “income from house property,” but with bigger

breaks.

You can deduct 30% of gross rent as standard allowance for maintenance—no receipts needed.

This drops your taxable rent sharply.

Interest on loans for purchase or construction? Deduct the full amount under Section 24(b), no

₹2 lakh cap like self-occupied homes. Salaried folks love this for offsetting high EMIs.

Depreciation: Silent Wealth Builder

Claim depreciation on the building (4%) and fittings (10-40%). This non-cash deduction lowers

taxable income further. For a ₹50 lakh office, it might save ₹2-3 lakh yearly in tax.

Business expenses like repairs, insurance, and property tax also qualify if you manage the space

actively.

Loan and Capital Gains Perks

Section 24 covers full loan interest, unlike residential’s limits. Processing fees count too. On sale, long-term capital gains (over 2 years) tax at 12.5% with indexation for pre-2024 buys reducing the effective rate. No Section 80C principal deduction, but new regime skips most anyway—stick to old for max savings.

| Deduction Type | Commercial Property | Residential (Let-Out) |

|---|---|---|

| Standard Allowance | 30% of rent | 30% of rent |

| Loan Interest | Full under Sec 24(b) | Full (no cap) |

| Depreciation | Yes, 4-40% | No |

| Principal (80C) | No | Up to ₹1.5L |

Why Salaried Pros Win Big

Your salary slab (20-30%) amplifies these breaks. A ₹10 lakh rent? Deduct ₹3L standard + ₹5L

interest + ₹2L depreciation = tax on ₹20k only.

GST on rent (18%) is reclaimable if tenants claim ITC, or pass it on. Under-construction buys

allow ITC too.

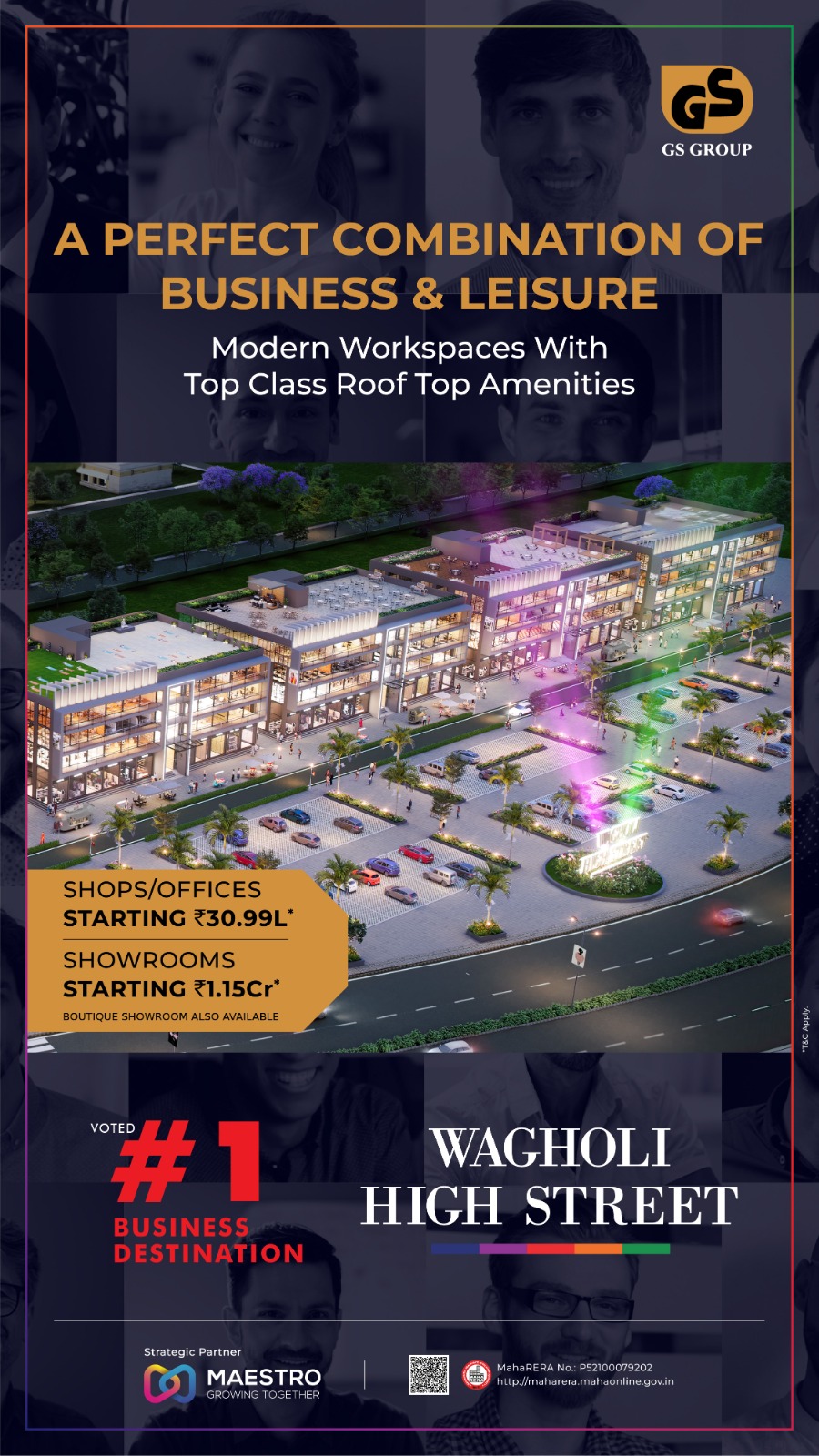

Pune's East: Tax + Yield Combo

East Pune spots like Wagholi offer 6-10% yields with metro boosts. GS Developers’ Wagholi High

Street delivers ready shops and offices primed for these benefits.

Start Saving Today

Commercial properties turn tax pain into gain for salaried earners. Pair deductions with rising

rents for real wealth.

Explore Wagholi High Street to lock in yields and savings now.

Read More

smart homes in pune

Smart homes in Pune use simple tech to make daily...

Read MoreWhy Wagholi’s Rental Yield Outpaces West Pune

Wagholi delivers higher rental yield than most established West Pune...

Read MoreSmart Homes on a Budget: How East Pune is Redefining Affordable Luxury

Discover the rise of budget-friendly smart homes in East Pune....

Read More